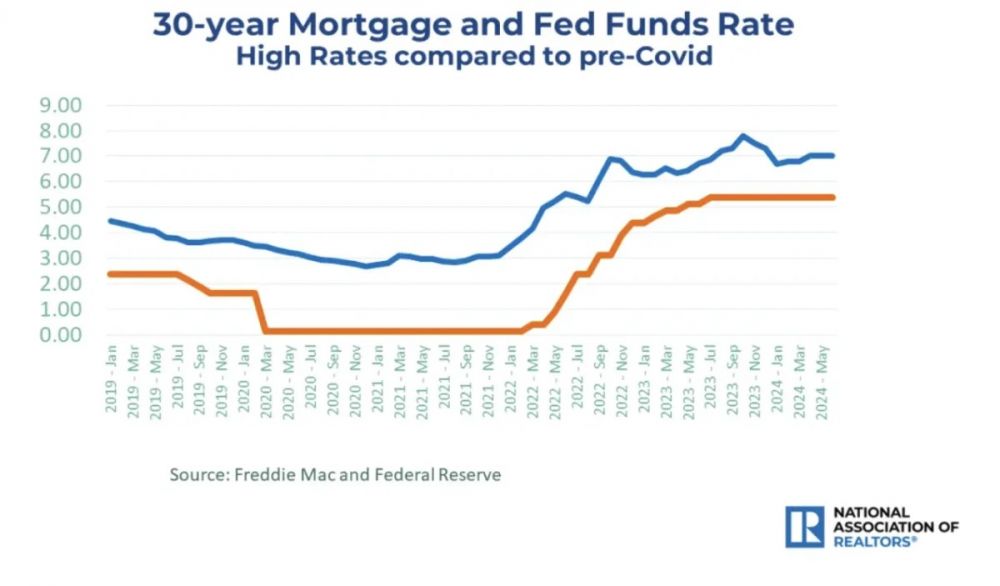

The latest inflation numbers show housing affordability remains a problem in the economic recovery.

Mortgage rates cooled slightly once again this week, now averaging 6.95%, as they continued to dial back after last month’s surge and returned to averages typical of a year ago, Freddie Mac reports.

“Mortgage rates continued to fall back this week as incoming data suggests the economy is cooling to a more sustainable level of growth,” says Sam Khater, Freddie Mac’s chief economist. “Top-line inflation numbers were flat but shelter inflation, which measures rent and homeownership costs, increased, showing that housing affordability continues to be an ongoing impediment for buyers on the house hunt.”

Inflation Remains a Thorn for Rates

The Federal Reserve voted this week to hold its key benchmark interest rate, blaming still stubbornly high inflation for delaying its plans for cuts. The Fed’s announcement came shortly after the latest consumer price inflation data showed the CPI up by 3.3% compared to a year ago. While that is its slowest gain in three years, the CPI remains far from the Federal Reserve’s 2% target that it has set as justification for starting to cut its rate.

The biggest pressure on inflation remains the shelter component of the CPI, which is up 5.4%. Shelter made its slowest gain in two years, but it remains high and continues to cause inflation to remain high as well, says Lawrence Yun, NAR’s chief economist. “The non-official private sector data points to rising apartment vacancy rates from temporary oversupply, and rents are essentially showing no increases,” Yun says. “So, official consumer price inflation, with a lag time, no doubt has more room to slow down.”

Yun says the timing for the Fed to start cutting rates remains unclear. “But the longer-term outlook is for the Fed to cut interest rates six to eight rounds by the end of next year,” he says. If mortgage rates then soon follow, “home prices will remain solid, and home sales will pick up, especially in regions with rising inventory,” he adds.

Mortgage Rates This Week

Freddie Mac reports the following national averages for mortgage rates for the week ending June 13:

- 30-year fixed-rate mortgages: averaged 6.95%, dropping from last week’s 6.99% average. A year ago, 30-year rates averaged 6.69%.

- 15-year fixed-rate mortgages: averaged 6.17%, falling from last week’s 6.29% average. Last year at this time, 15-year rates averaged 6.10%.

information provided by: National Association of Realtors